How to Reduce Your Healthcare Costs and Save Money

Good health is priceless, but the path to achieving it can unfortunately come with high costs. Consumers’ concerns about paying for healthcare are rising. Approximately 72 million U.S. adults felt less prepared to pay unexpected healthcare costs in 2022 than they did in 2021, according to a survey by consulting firm Deloitte.

Facing the high cost of healthcare can be daunting, but you can pursue an array of options to reduce healthcare costs. From taking advantage of preventive healthcare to opting for generic drugs and negotiating medical bills, the options for paying less to achieve and maintain good health are definitely worth learning.

Why It’s Important to Reduce Healthcare Costs: Trends in Healthcare Expenditures

Healthcare Costs Are Rising

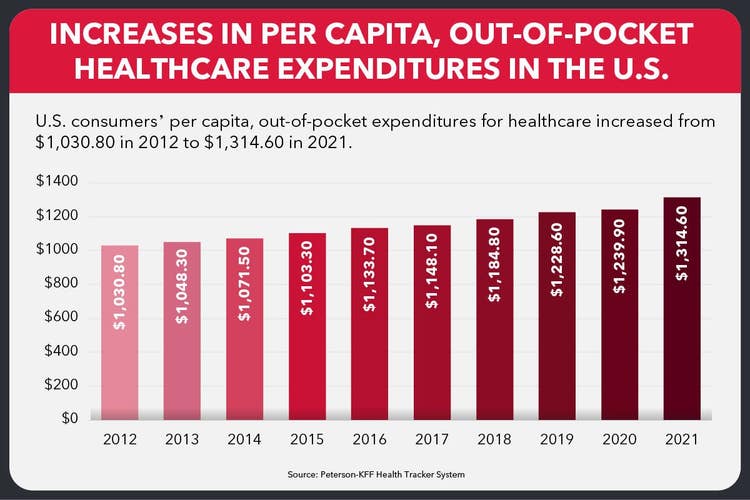

U.S. consumers’ per capita, out-of-pocket expenditures for healthcare increased from $1,030.80 in 2012 to $1,314.60 in 2021, according to the Peterson-KFF Health Tracker System. 2012: $1,030.80. 2013: $1,048.30. 2014: $1,071.50. 2015: $1,103.30. 2016: $1,133.70. 2017: $1,148.10. 2018: $1,184.80. 2019: $1,228.60. 2020: $1,239.90. 2021: $1,314.60.

Any discussion of healthcare costs would be incomplete without mentioning the rising cost of prescription drugs. According to a report on drug price increases from the U.S. Department of Health and Human Services, from July 2021 to July 2022:

- The average price increase for 1,216 drugs was 31.6% (compared with an inflation rate of 8.5%).

- The prices of some individual drugs increased by at least 100%. Examples included drugs to address health issues such as chronic heart failure and hypertension.

The overall cost of healthcare in the U.S. does not compare favorably with costs in other wealthy countries. A report by the Peterson Center on Healthcare and KFF comparing healthcare costs around the world found that:

- On average, the U.S. spends more than twice as much per person on healthcare than other large, wealthy countries.

- In 2021, U.S. healthcare expenditures represented 18.3% of gross domestic product, while the average percentage in other comparable countries was 11.4%.

An Aging Population and Chronic Disease Are Affecting Healthcare Costs

Certain attributes of the U.S. population also are affecting the cost of healthcare. For example:

- The population is aging. Life expectancy at birth will increase from 77.1 to 82.3 from 2022 to 2052, according to the Congressional Budget Office (CBO). The CBO estimates that roughly one-third of the projected increase in spending on major healthcare programs during that time period will be due to our aging population.

- Chronic disease is prevalent. Chronic diseases are the primary drivers of U.S. healthcare costs, the U.S. Centers for Disease Control and Prevention (CDC) report. They cite diabetes as the most expensive chronic disease: $1 out of every $4 in healthcare costs is related to caring for individuals who have diabetes.

The Consequences of the High Cost of Healthcare

The toll that high healthcare costs take shows why it’s important to reduce healthcare costs. The consequences of high healthcare costs are sobering. For example, people have:

- Postponed medical treatment. Thirty-eight percent of Americans reported that they or a member of their family had postponed medical treatment because of the associated cost, according to a 2022 Gallup poll. That percentage was 26% in 2021.

- Skipped prescriptions or did not take medicine as prescribed. Due to the cost of prescription medication, 29% of respondents had not filled a prescription, taken over-the-counter medicine in lieu of a prescription, cut prescribed pills in half, and/or skipped doses of a prescription, according to a 2022 KFF survey on prescription drugs.

The high cost of healthcare affects minorities and people who have relatively low incomes more than other demographic groups. For example, results of a separate 2022 KFF survey on healthcare costs found the following:

- Individuals reporting that it was somewhat or very difficult to afford healthcare by race/ethnicity:

- 39% of white respondents

- 60% of Black respondents

- 65% of Hispanic respondents

- Individuals reporting that it was somewhat or very difficult to afford healthcare by household income:

- 21% of respondents whose annual salary was at least $90,000

- 49% of respondents whose annual salary was between $40,000 and $89,900

- 69% of respondents whose annual salary was less than $40,000

7 Ways for You to Reduce Healthcare Costs

1. Get Routine Screenings and Preventive Care

It’s important to take advantage of any healthcare benefits you may have to get routine health screenings and preventive care. Not only can this keep you healthy, but it also can identify health issues early and therefore reduce healthcare costs. People frequently pay no copay for services such as health screenings, regular well visits, and vaccines, the National Library of Medicine’s MedlinePlus service notes.

Even if you have insurance, out-of-pocket expenditures associated with common health issues such as cancer can add up. For example, the average annual, out-of-pocket cost for breast cancer patients who had health insurance was $1,502 (in terms of 2022 dollars), according to a report in JAMA Network Open. Regular mammograms can help to reduce those costs. The cost to treat breast cancer that is diagnosed early is significantly lower than the cost of treatment for late-stage breast cancer, according to the U.S. Centers for Disease Control and Prevention.

2. Be Careful to See In-Network Providers

It’s also important to see healthcare providers that are in your health insurer’s specified network. When health insurance marketplace eHealth surveyed 6,500 healthcare consumers in 2022, it found that 20% of those surveyed had gone to out-of-network providers. Those consumers spent an average of about $900 more for healthcare than consumers who saw only in-network providers.

Consumers can take several actions to help ensure they remain within a network of providers. For example, eHealth recommends the following:

- If you have the opportunity to shop for health insurance or choose among employer-offered health insurance plans, review provider network information carefully. This can help you determine, for example, whether the network includes a provider you prefer or whether in-network providers are located nearby.

- Become informed about how your health insurance handles emergency situations. For example, some insurers may waive additional fees for out-of-network providers that you visit in an emergency. However, after those providers discharge you, insurers may not cover additional care from those providers.

3. Know Your Health Insurer’s Rules

Becoming educated about your health insurer’s rules also can help decrease healthcare costs. For example, your insurer may have rules requiring you to:

- Obtain prior authorization from your insurer before getting a medical procedure. If you don’t obtain the required prior approval, the insurer can refuse to pay for your treatment, and you will be responsible for paying the costs.

- Obtain a referral from your primary care physician to see a specialist. Failure to secure a required referral could result in your insurer’s refusing to cover the cost of a specialist visit.

4. Review Whether Your Healthcare Expenditures Are Tax Deductible

Don’t forget that if your annual expenditures on healthcare exceed a certain threshold, you can take a federal income tax deduction. Specifically, for tax year 2022, the U.S. Internal Revenue Service reports that you can deduct the portion of your medical and dental expenses that exceeds 7.5% of your adjusted gross income.

NerdWallet offers an example of this deduction in action. If your adjusted gross income is $40,000, then you could deduct any healthcare expenditures in excess of $3,000 (7.5% of $40,000). If your healthcare expenditures totaled $10,000, for example, you could deduct $7,000 (the amount in excess of the $3,000 threshold).

5. Use the Emergency Department Appropriately

If you have a medical emergency, of course it’s important to visit an emergency department. But visiting emergency departments for convenience in nonemergency scenarios can be expensive. MedlinePlus reminds healthcare consumers that:

- The cost of care in an emergency department can be two to three times the cost of the same care at your provider’s office.

- Health insurers may set higher copayments for emergency department care than for care in a provider’s office.

6. Act on Your Own to Maintain Your Health

Committing to regular exercise, if you are able, and adopting a nutritious diet not only promotes better health, it also can go a long way toward reducing healthcare costs in the long run. For example, according to the CDC:

- Obesity in the U.S. leads to $173 billion in healthcare costs each year.

- Inadequate physical activity in the U.S. leads to $117 billion in healthcare costs each year.

Some health insurance companies offer wellness programs that can boost your health and provide financial incentives such as:

- Financial rewards for completing activities such as health screenings and wellness exams

- Discounts on gym memberships

- Discounts on weight loss programs

7. Use Your Health Savings Account

Health savings accounts (HSAs) also are a great way to make your money go further. Depending on their tax bracket, individuals who fund their HSAs with the maximum allowable amount could save between about $700 and $1,300 each year.

HSAs enable consumers to set aside pre-tax dollars to pay for qualified medical expenses. In some cases, employers also contribute to their employees’ HSAs. The advantages of HSAs make them worthy of any consumer’s consideration.

Health savings accounts offer several advantages to consumers, according to Fidelity Investments. 1. HSAs are a good vehicle to save for out-of-pocket healthcare costs. 2. HSA funds are not subject to a “use-it-or-lose-it” requirement. 3. Many employers also contribute funds to employees’ HSAs. 4. You can use HSA funds for future qualified medical expenses in retirement. 5. HSA withdrawals, contributions, and earnings are not subject to federal income tax.

How to Save Money on Prescriptions

People also can act to reduce what they pay for prescription drugs. Knowing how to save money on prescriptions can help you curb healthcare costs. For example, you can reduce the cost of prescriptions by:

- Using generic drugs when possible. The use of generic drugs and biosimilar medicines resulted in $373 billion in cost savings in 2021, According to a report by the Association for Accessible Medicines. Generic drugs have the same strength, active ingredients, and purity as name-brand drugs. Biosimilar medicines are very similar to name-brand medicines and have no clinically meaningful differences from name-brand medicines. Newer name-brand medicines have a period of exclusivity before generic versions become available.

- Joining prescription savings clubs. Individuals can save money by joining prescription savings clubs offered by retailers such as Walgreens, Walmart, and Kroger. These clubs offer price reductions on hundreds of generic drugs, even if you have no health insurance. As of 2022, annual club membership fees were around $20 for a single person or $35 for an entire family.

- Participating in pharmaceutical company discount programs. Consumers can go directly to pharmaceutical manufacturers and participate in the discount programs they offer. While the savings these programs offer can be significant, consumers still may be able to save more money by using generic drugs (when available).

- Buying drugs in larger quantities or receiving them through the mail. Individuals can save substantial amounts of money by purchasing more than a 30-day supply of a prescription. Ordering prescriptions online and receiving them through the mail also can reduce costs.

- Searching for coupons. For example, GoodRx coupons can enable individuals to reduce the price they pay for generic drugs and some name-brand drugs by as much as 80%.

- Using apps to compare prescription prices. Individuals can take advantage of a number of apps to compare prices of prescriptions at different pharmacies.

How to Reduce Medical Bills

Even after you receive a medical bill, you still have some cost-saving options. Equipped with the knowledge on how to reduce medical bills, you can take control of your healthcare costs and save money on healthcare.

For example, don’t forget that you can try to negotiate medical bills. Consumers can take advantage of specific ways to negotiate to reduce the amount they owe or make payments more manageable.

Consumers can take advantage of different ways to negotiate their medical bills and reduce what they pay, according to SoFi. 1. Don’t hesitate to dispute any errors. 2. Negotiate to pay a lump sum that is slightly lower than the total bill. 3. Provide any evidence of overcharges. 4. Work out a payment plan to pay the bill over a longer time period.

Other avenues for lowering the cost of medical bills include:

- Working with a medical billing advocate. Medical billing advocates have expertise that can help reduce your medical bills. It’s important to know what these experts charge before hiring them, but they can offer help when you feel unable to carry out a negotiation on your own.

- Researching financial assistance programs for medical bills. Financial assistance programs are available to help individuals pay their medical bills. For example, the Affordable Care Act requires nonprofit hospitals to provide discounted or free care. In addition, some states’ charity care laws require hospitals to provide free or discounted care to eligible individuals.

- Take advantage of the federal No Surprises Act. Starting in 2022, federal law enabled an individual to dispute a medical bill if the final charges exceeded the good faith estimate by a minimum of $400. You need to file your dispute within 120 days of the date on the bill.

Innovations from the COVID-19 Pandemic That Can Lower Healthcare Costs in the Future

Increased Use of Telehealth

Patients became more familiar with telehealth during the pandemic and have continued to use it. Telehealth represented less than 1% of claims in February 2020, but almost 6% of claims in January 2023.

The average cost of a nonurgent telehealth visit is approximately $93 lower than an in-person visit, and the average cost of a telehealth visit with a specialist is $120 less than an in-person visit.

Expanded Nurse Practitioner Authority

Several states that temporarily expanded practice authority for nurse practitioners (NPs) during the pandemic are making those changes permanent. Not only will this increase the availability of healthcare providers, but it can reduce healthcare costs.

For example, when a registered nurse joins the growing ranks of family care nurse practitioners by completing an NP degree program, this can lower the cost of primary care. For low-risk patients, the cost of primary care provided by medical doctors is 34% higher than that provided by NPs — even though the quality of care that nurse practitioners provide is comparable to or even better than the care that medical doctors provide.

Increased Care Provision in Non-Acute Settings

The effects of COVID-19 on hospital costs are also driving changes in the settings where patients receive care, and this can result in cost savings.

The pandemic sped up an ongoing shift in the locations where patients receive care from acute settings to non-acute settings. Costs in acute settings are generally higher than costs in non-acute settings.